By Eric Gomez

Taiwan’s Ministry of National Defense (MND) released a document in June 2025 that reports on the status of several US arms sales to the Legislative Yuan (LY). This is the third such document that I have found in my work on the arms sale backlog, with previous iterations released in June and October of last year. These MND reports are very valuable sources of information about the status of US arms sales to Taiwan. The June 2025 report does not contain any major surprises, but it does offer some additional bits of information.

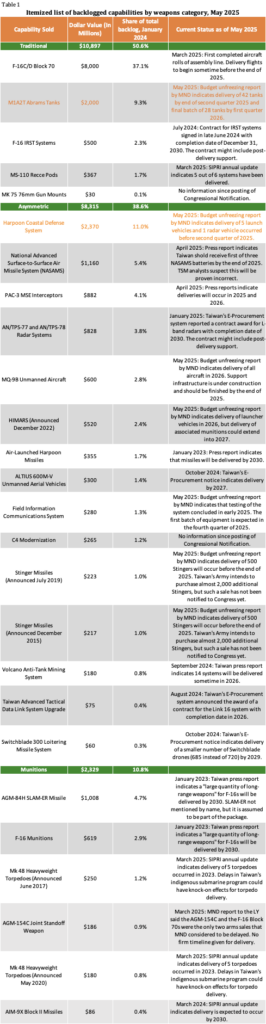

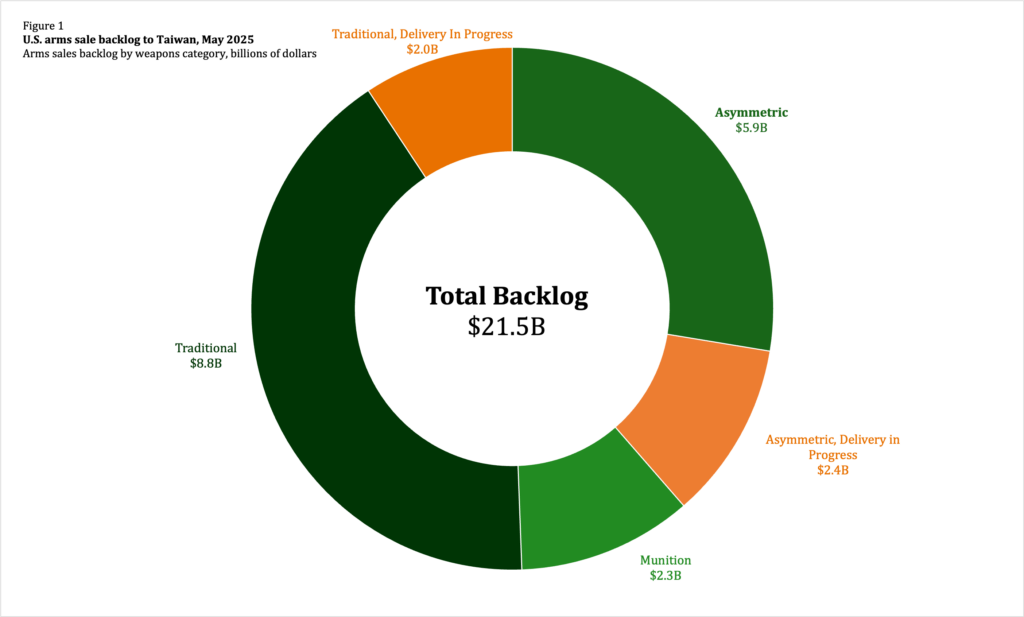

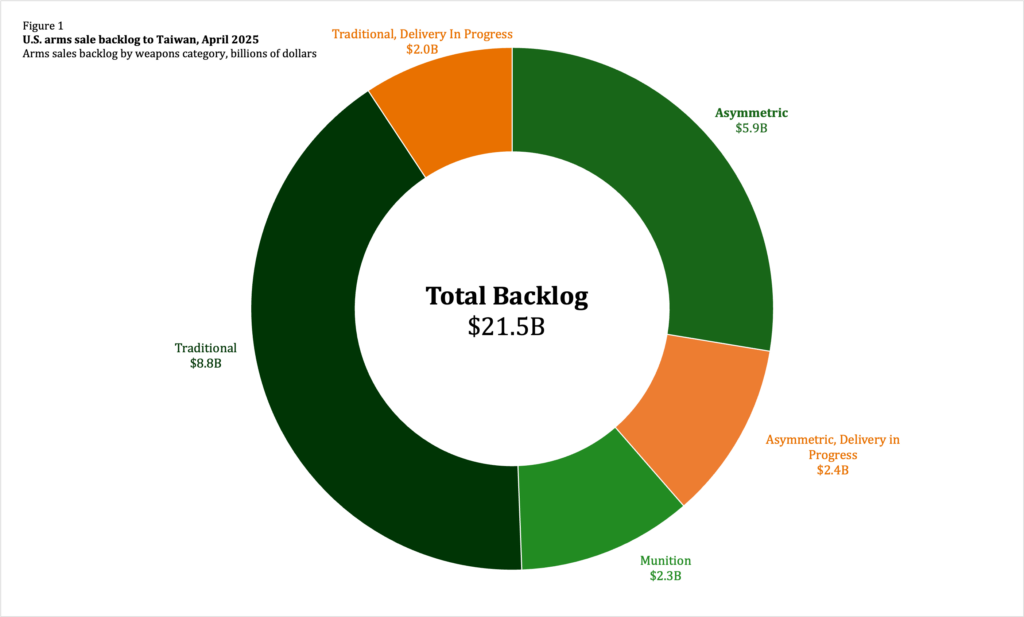

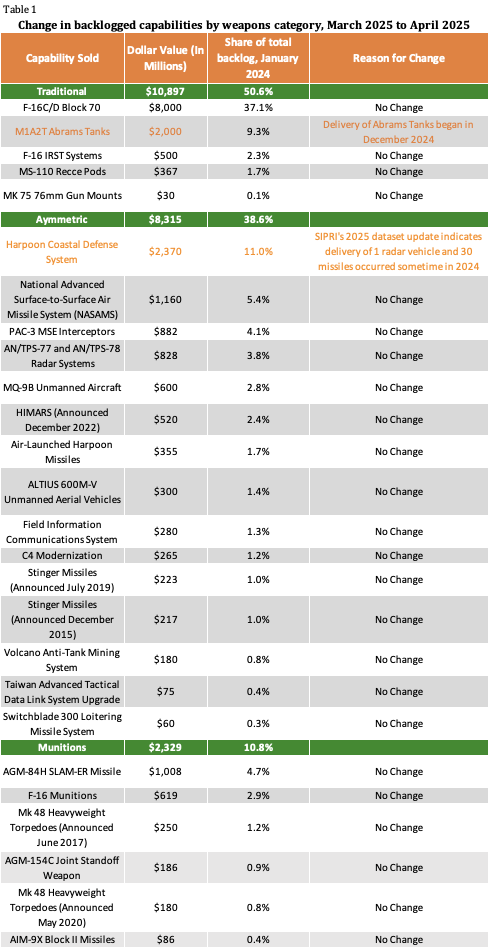

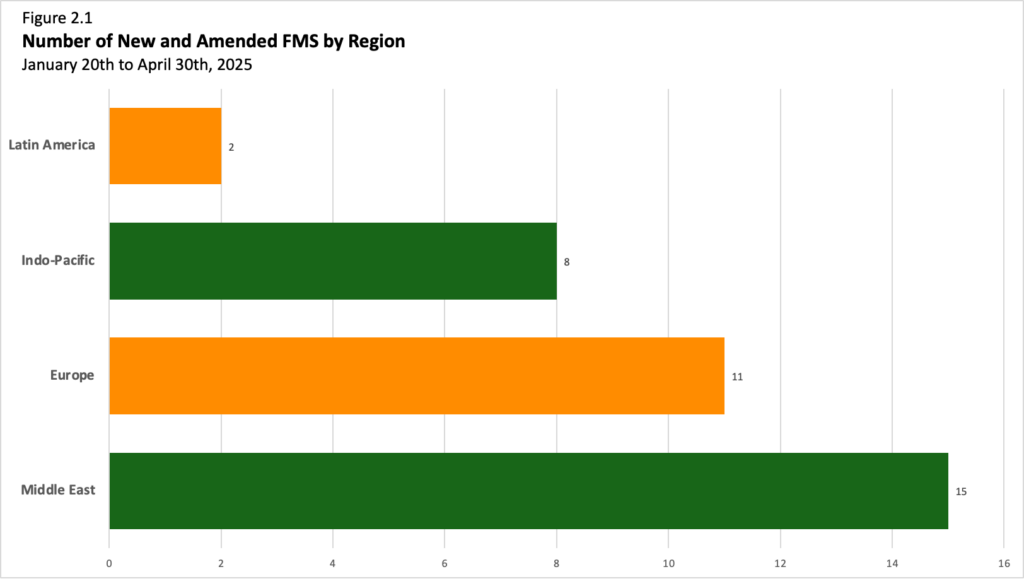

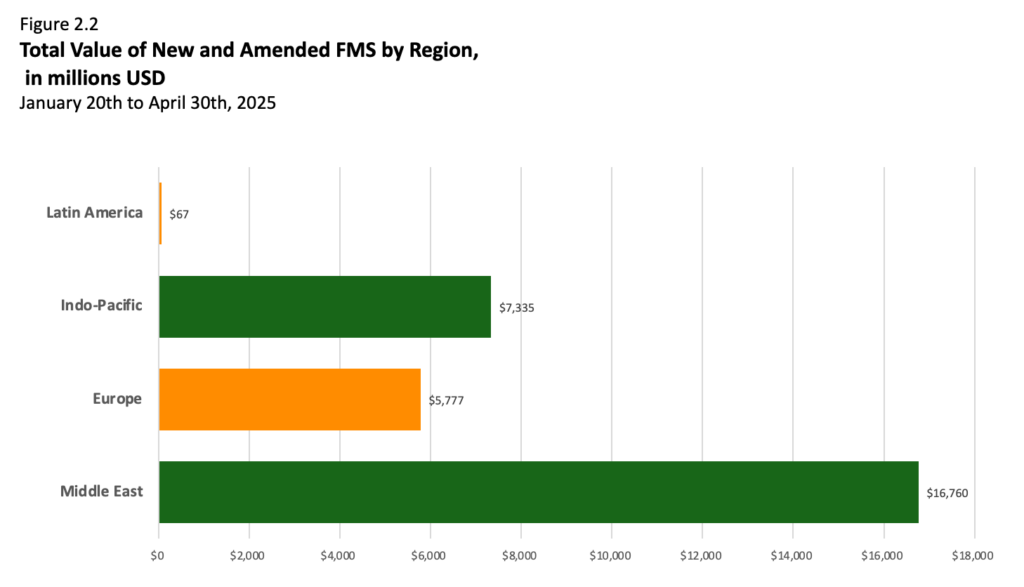

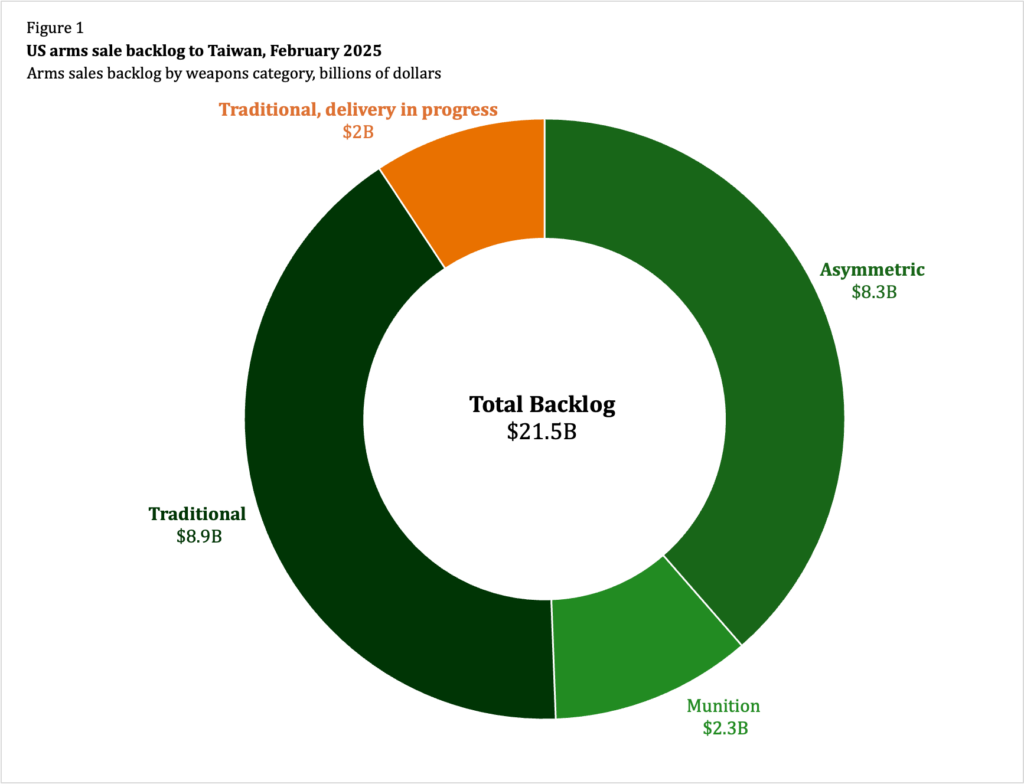

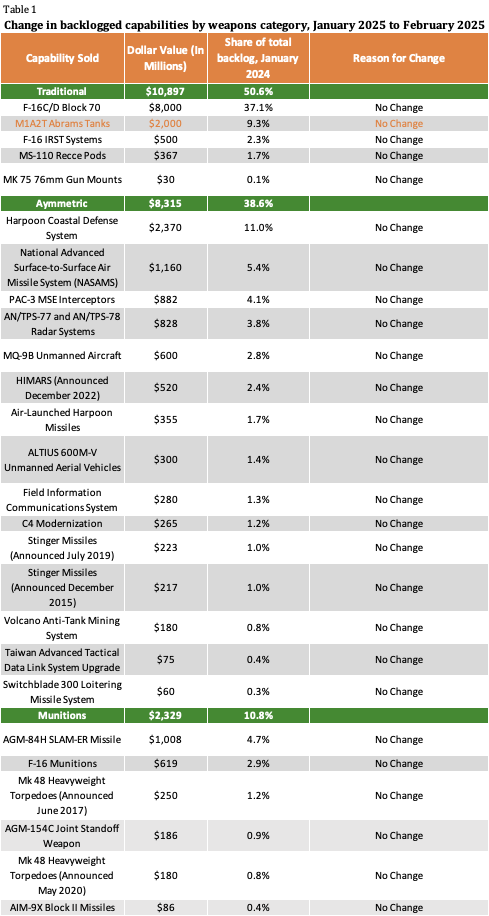

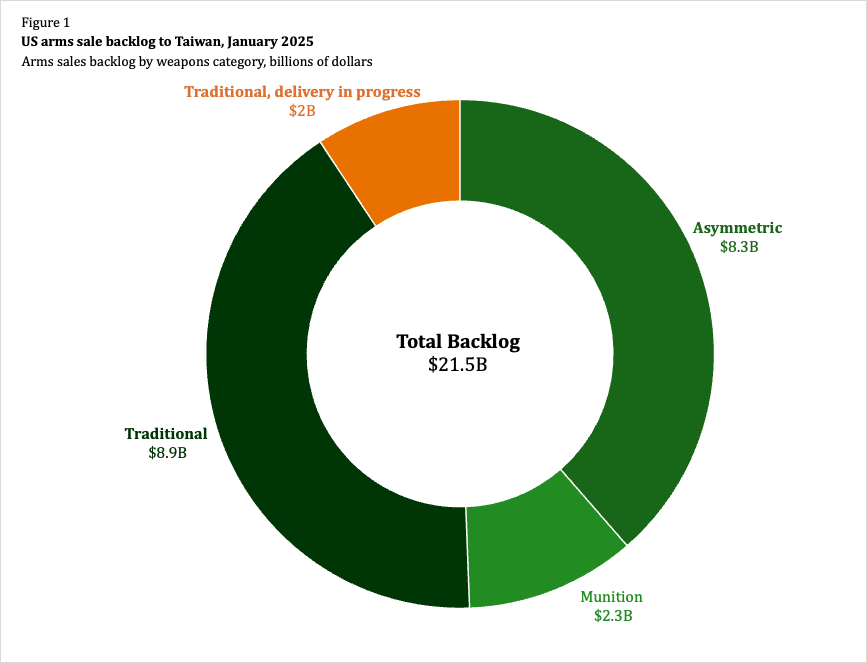

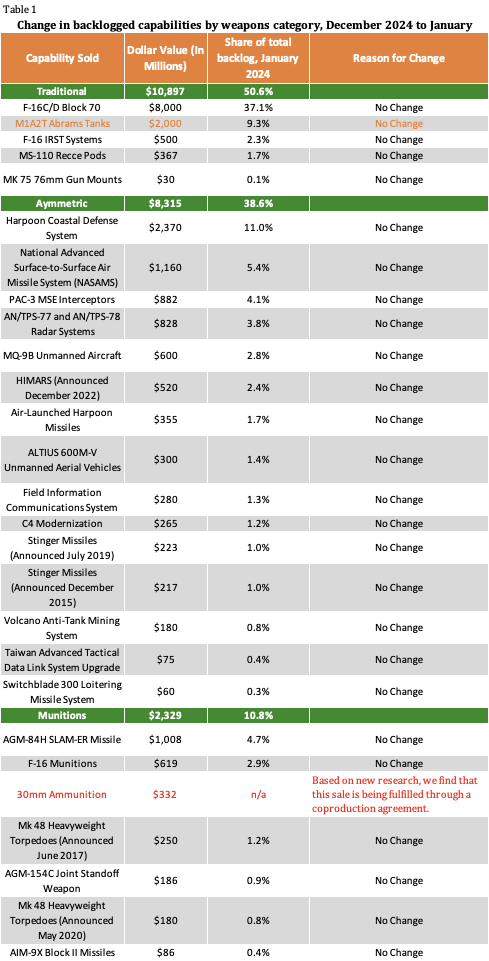

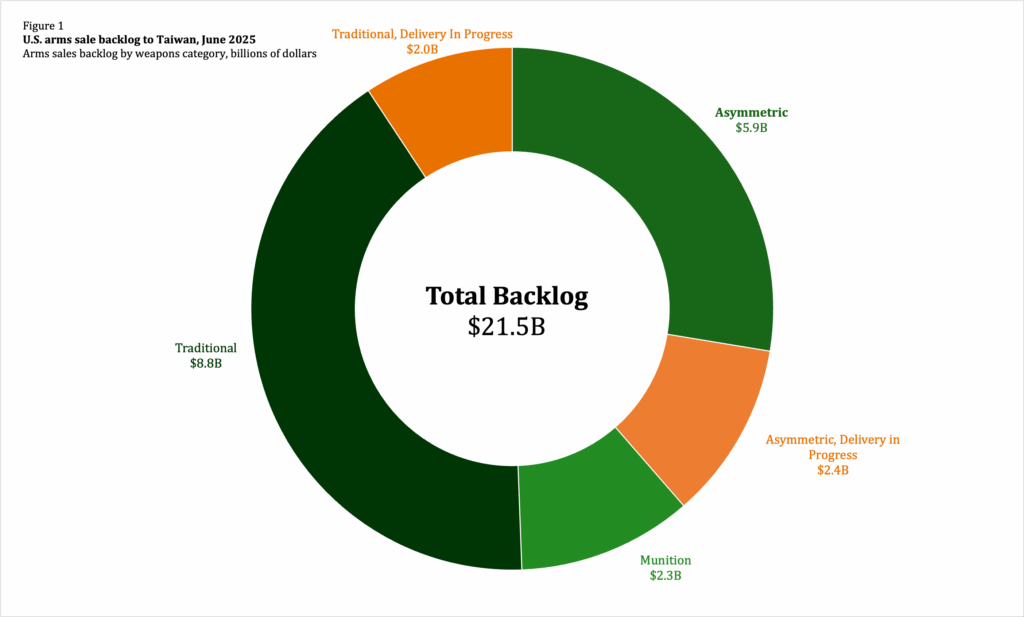

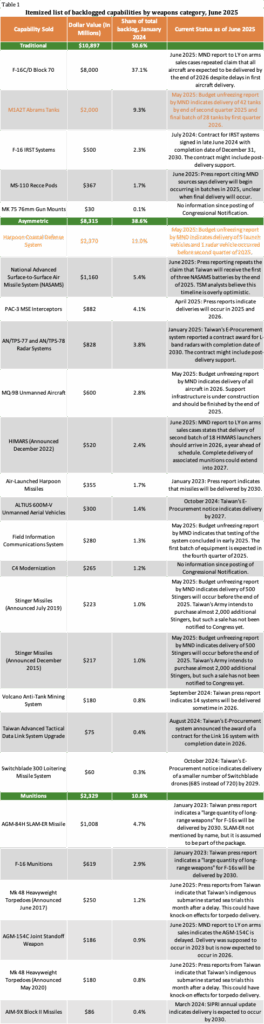

There were no new arms sales to Taiwan notified to Congress in June 2025 and no reports of weapons deliveries either. The backlog remains valued at $21.54 billion, with just shy of $4.5 billion of this figure covering deliveries that have begun but are not finished. Figure 1 shows how the backlog is broken down between traditional capabilities, asymmetric capabilities, and munitions. Table 1 shows an itemized list of what arms sales are in the backlog, with information about their most recently known status.

Before delving into the MND report, I did want to highlight two other developments in June 2025.

Early in the month, Raytheon was awarded a $1.1 billion contract modification to produce several variants of approximately 2,000 AIM-9X air-to-air missiles, with over half earmarked for Foreign Military Sales (FMS) customers. The contract has a completion date of October 2028. The contract award announcement does not list specific FMS customers, but Taiwan is waiting for delivery of 100 AIM-9X Block IIs from an FMS case notified to Congress in September 2022. Updates on the AIM-9X case have been hard to find, but the contract award announcement is a good sign for Taiwan and many other countries.

The other backlogged arms sale that received an update in June 2025 is an FMS case for six MS-110 reconnaissance pods, which was notified to Congress in October 2020. SIPRI’s arms transfer dataset reports that almost all these pods were already delivered to Taiwan. However, a report by Taiwan’s Central News Agency in June 2025 that cites an MND source says that delivery of the MS-110s should begin 2025, though CNA did not provide an end date for delivery. This would suggest that SIPRI’s information is incorrect or out of date.

MND’s Arms Sale Report to the LY The three MND reports to the LY on US arms sales to Taiwan that I have translated follow a similar pattern. All the reports give a total number of active arms sales cases and mention how many of those cases are considered on time, delayed, or ahead of schedule. Most of the arms sale cases are on schedule, but there is no additional information on these cases. The overall number of cases mentioned in the MND report are slightly different from the overall number in our TSM dataset. I suspect, but cannot definitively prove with current data, that the MND does not include an arms sale on its list unless the sale has a signed Letter of Offer and Acceptance (LOA). A LOA contains a detailed payment schedule and expected delivery timeline for an FMS case and must be signed before the US military can enter a contract with the defense industry to produce new weapons systems.

There can sometimes be delays of one or two years between an FMS case being notified to Congress and a LOA being signed. So, it is possible that many recent arms sales to Taiwan (there were seven notified to Congress in 2024) are not included in MND’s list because their LOAs are being negotiated.

The June 2025 edition of the MND arms sales implementation report indicates that there are 18 arms sales currently in progress, with 15 on schedule, 2 delayed, and 1 ahead of schedule. The two delayed arms sales are AGM-154C Joint Standoff Weapon (JSOW) guided glide bombs and F-16 Block 70 fighter aircraft.

The JSOW sale was notified to Congress in 2017 and is one of the oldest arms sales in the backlog. The MND report says the bombs were supposed to be delivered in 2023 but limited production capacity and delays in testing pushed this back by three years to 2026. The JSOWs are supposed to arm Taiwan’s older F-16A/B fighter jets, which completed a major upgrade in late 2023. The three-year delay would mean a total gap of nine years between congressional notification and final delivery for the JSOWs. Taiwan is only purchasing around 50 bombs.

Delays in the new production F-16 Block 70 aircraft are less severe, but still noteworthy. I have previously written about the F-16 Block 70 delays for Taiwan Security Monitor. The June 2025 MND report does not contain any new information on the timeline for delivery. The MND is confident that all 66 aircraft will arrive in Taiwan before the end of 2026, despite the first aircraft only rolling off the assembly line in March 2025. In other words, the MND claims that final delivery of the F-16s will not be delayed despite delivery of the first aircraft occurring over a year behind schedule.

Finally, the June 2025 MND report echoes reporting from other sources on early delivery of the second batch of 18 HIMARS launchers, which are now expected in Taiwan before the end of next year—one year ahead of schedule. The 18 HIMARS were notified to Congress at the end of 2022, which would mean a little less than a four-year gap between notification and final delivery. By comparison, Taiwan’s first batch of 11 HIMARS took four years from notification (October 2020) to final delivery (November 2024), so Taiwan has a slightly shorter wait time for a larger order. It will probably take until 2027 for Taiwan to receive all the HIMARS munitions it is purchasing, but for the purpose of the backlog dataset once all launchers are in Taiwan I will consider the case to be delivered.