In First 100 Days Trump Sells a Lot of Weapons, Just Not to Taiwan

By Eric Gomez

The Trump administration celebrated its 100th day in office on April 30, 2025. Foreign Military Sales (FMS) were not one of the items that the administration trumpeted as it marked this milestone. That is not very surprising. While huge nerds like me and you reading this love to follow this stuff, arms sales are not usually high on any administration’s list of Things to Trumpet. But, because people like you and me exist, let’s look at Trump’s first 100 days of FMS cases.

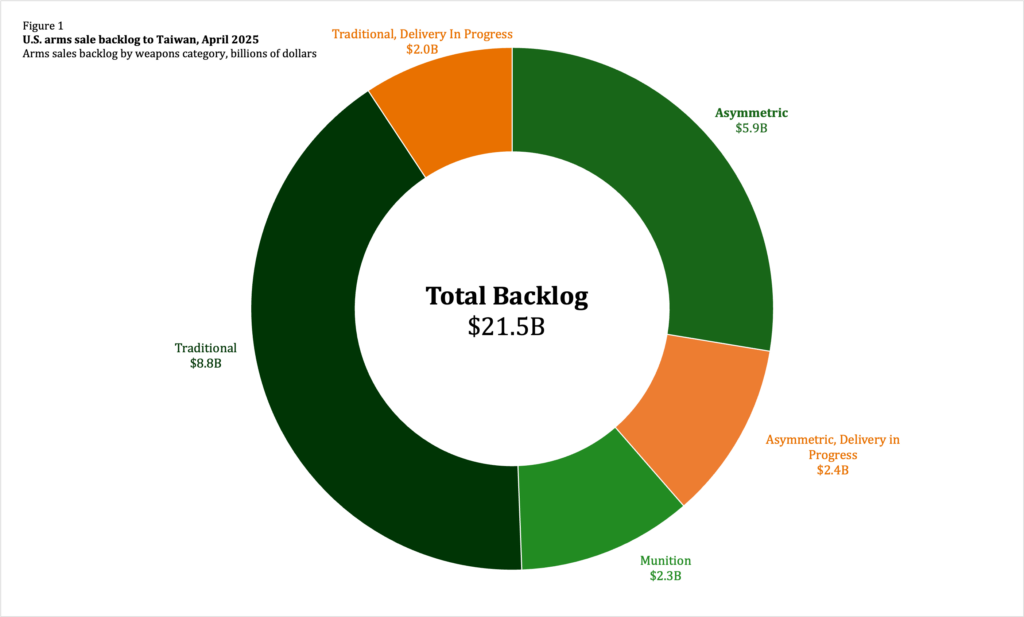

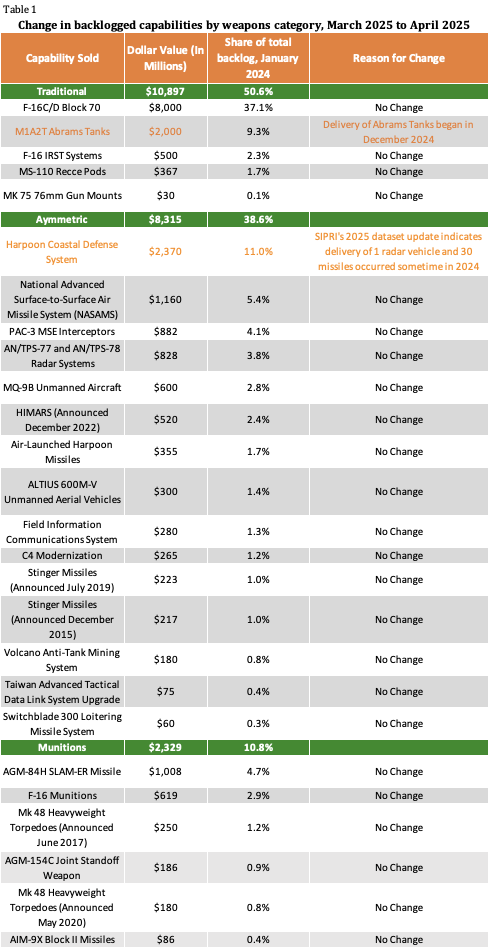

Since this is Taiwan Security Monitor, let’s talk about Taiwan first. There were no FMS cases notified to Congress in Trump’s first 100 days, and there were no reports of major arms sales being delivered to Taiwan in April 2025. I assess the total dollar value of the backlog to remain at $21.54 billion— but there might be some good news for the backlog to report next month (I realize the irony of an arms sale backlog dataset suffering from a backlog of monthly posts). See Figure 1 for the breakdown of the backlog by weapons category and Table 1 for an itemized list.

There were two items of reporting out of Taiwan in April 2025 worth mentioning:

First, Taiwan’s Air Force announced that it would form an additional Patriot battalion as its inventory of interceptors grows. In December 2022, Congress received notification of an amendment to an older FMS case for Patriot systems. The amendment added 100 PAC-3 MSE interceptors and upgrades to launcher systems. Press reports and statements from Taiwan’s Ministry of National Defense have consistently said that they expect all 100 PAC-3 MSEs to arrive by the end of 2026, but the April 2025 reporting is the first time where new military units have been mentioned.

Second, Taiwan’s indigenous submarine program missed its planned start time for sea trials, which were supposed to run from April to September of 2025. The relevant FMS case in the backlog are two cases for heavyweight torpedoes worth a combined $430 million. Accurate data on the delivery timeline for the torpedoes has been hard to find, but if a delay in sea trials leads to a delay in the submarine entering service, then it would not be surprising to see a knock-on delay in the torpedoes. Taiwan Security Monitor will keep an eye on this and report any developments as soon as possible.

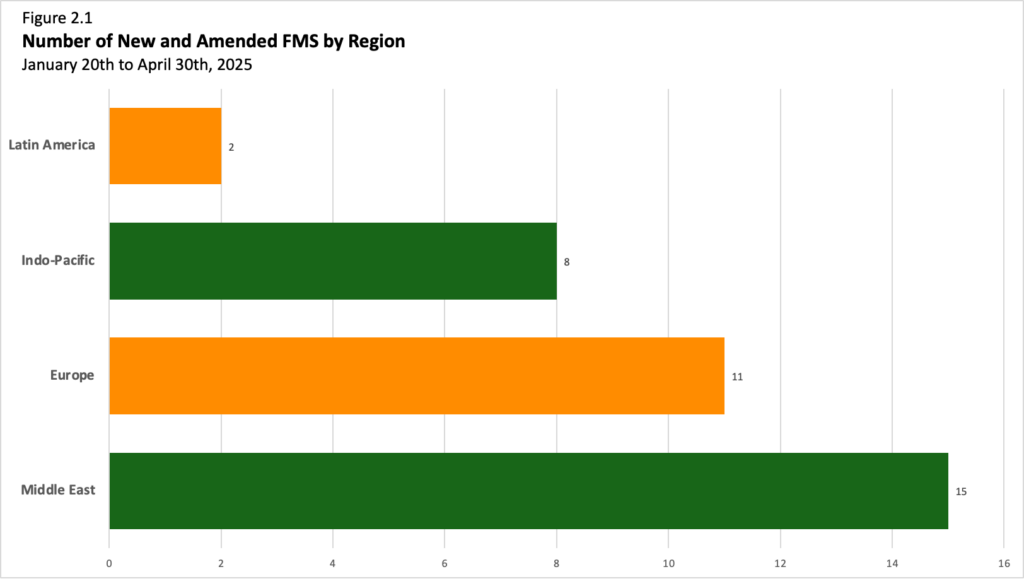

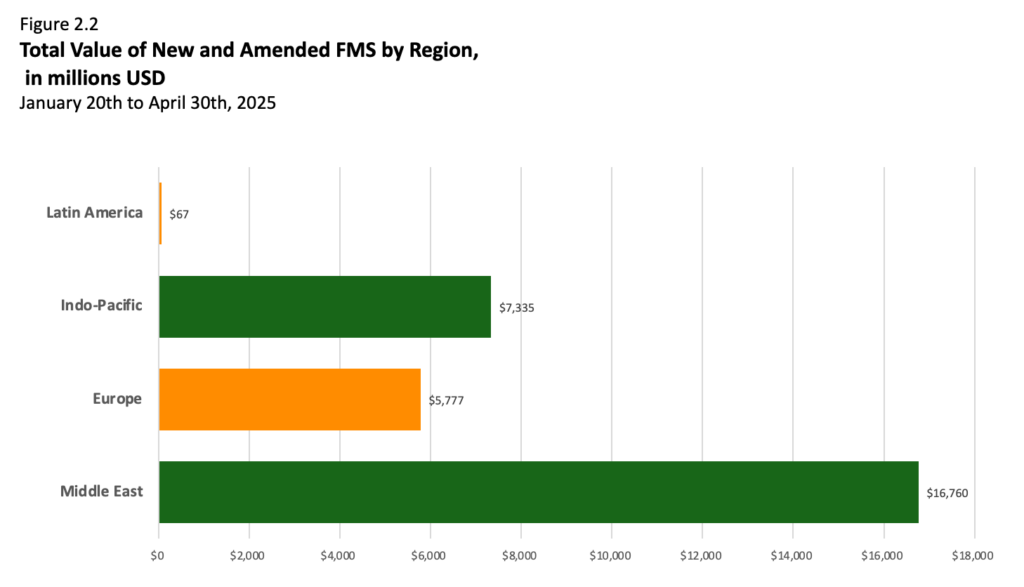

Trump’s First 100 Days of Arms Sales

April 2025 was an incredibly busy month for FMS cases being notified to Congress and the last day of the month coincided with Trump’s 100th day in office. In April alone, Congress received notifications of 18 FMS cases, both new and modifications to older sales, totaling nearly $14 billion. Looking at the first 100 days of the administration, these numbers increase to 36 FMS cases worth almost $30 billion. The Taiwan Security Monitor team created two graphics to visualize this data. Figure 2.1 shows the number of FMS cases by region while Figure 2.2 shows the dollar value of the cases by region.

The Middle East has been the biggest beneficiary of new FMS cases in Trump’s first 100 days, holding the number one spot in terms of both the number of new cases (15) and the overall dollar value ($16.7 billion). Israel has been the single largest beneficiary of FMS cases by dollar value in this period, with $10.6 billion notified. Almost all the Israel arms sales were for munitions, such as bombs and missiles.

The Indo-Pacific and Europe have also received a substantial amount of FMS support from the Trump administration despite concerns about Trump’s treatment of US allies. Many of these FMS cases have been for munitions— the AIM-120 family of air-to-air missiles have been selling like hot cakes— but these also include some noteworthy major platforms such as a sale of 20 F-16s and related munitions to the Philippines for $5.5 billion and 175 Tomahawk missiles for the Netherlands for a little over $2 billion.

Given the processing times for FMS cases, it is possible that many of these cases being notified to Congress were already in the works before Trump took office, although as more time goes by this potential explanation becomes less likely. Trump was a big fan of arms sales in his first administration, however, and one of the Executive Orders in the first 100 days of his second administration is focused on reforming the arms sales process to speed up the delivery of weapons.

Conclusion

The world is still waiting to see what will be in the Trump administration’s first arms sale to Taiwan. As Taiwan Security Monitor has reported previously, there are rumors of a multi-billion-dollar package in the works, but both the dollar value and capabilities keep changing. Whatever ends up being in the eventual Taiwan arms sale will be an important bellwether, we at Taiwan Security Monitor will keep waiting for the announcement.