Second Batch of Abrams Tanks Arrives

By Eric Gomez and Joseph O’Connor

A second batch of Abrams tanks arrived in Taiwan in late July, but besides this development, July was quiet in terms of arms sales updates. From July 9-18, Taiwan’s military conducted its annual Han Kuang series of exercises, which featured several developments of note.

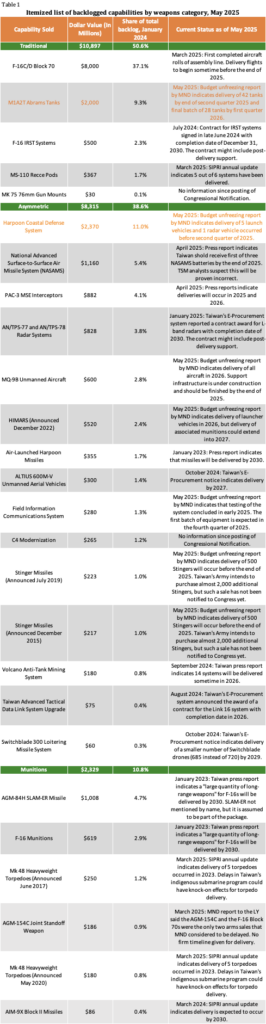

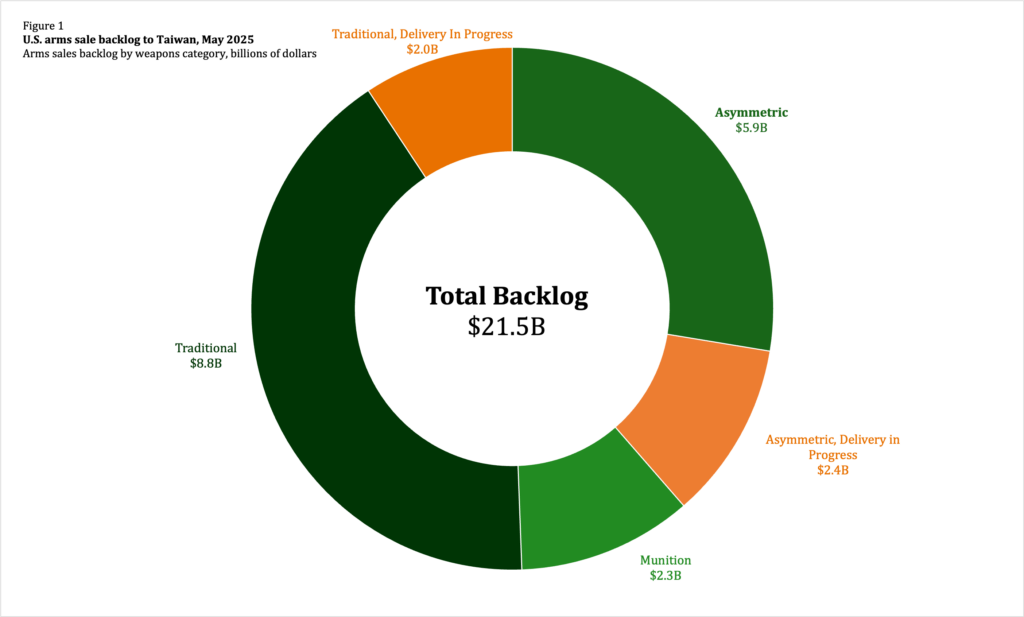

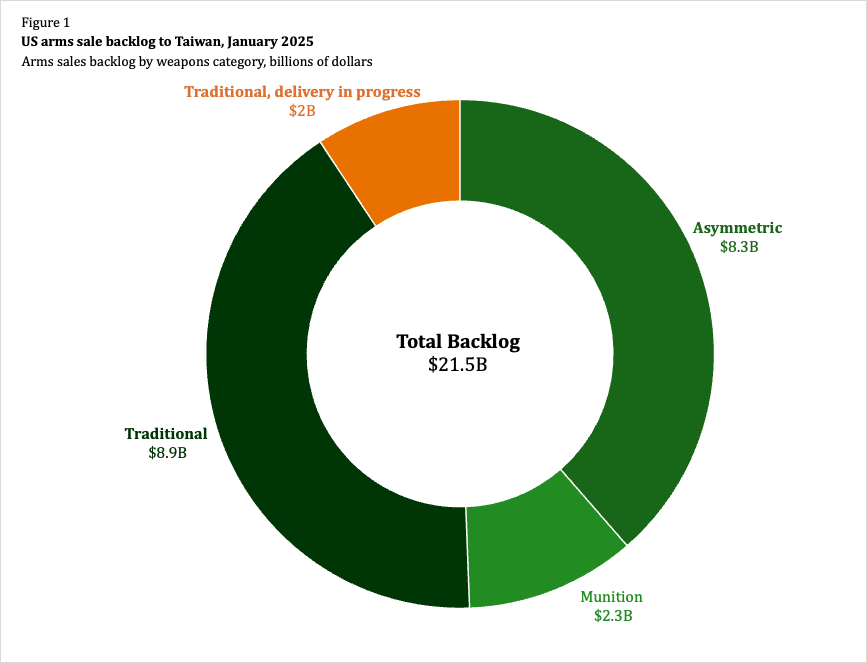

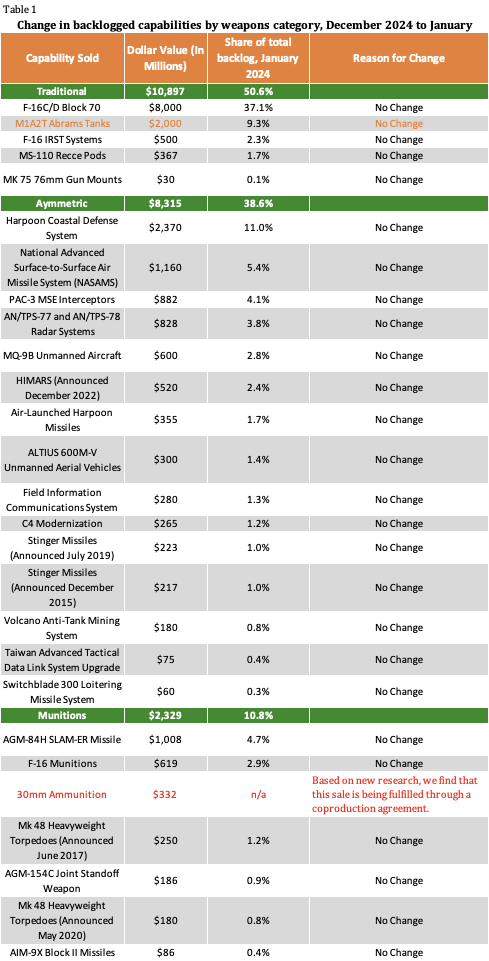

The Taiwan Security Monitor (TSM) dataset only removes an arms sale from the backlog when it is fully delivered. Therefore, the overall size of the U.S. arms sale backlog to Taiwan remains $21.54 billion. However, for arms sales valued at over $1 billion, deliveries in progress are marked in yellow-orange in our visualizations.. Figure 1 shows the current composition of the arms sale backlog by weapon category. Table 1 shows an itemized list of arms sales in the backlog with the most recently available information about their status.

Han Kuang Exercise

The biggest development in Taiwan security news in July was the annual Han Kuang exercise. Han Kuang is Taiwan’s largest and most highly publicized exercise. The 2025 iteration featured several notable changes from previous years. The TSM team conducted real-time open-source analysis of the Han Kuang exercise that can be found on our X account.

One of the most widely covered new aspects of the Han Kuang exercise was increased realism in engineering and logistics aspects of the exercise to better simulate wartime conditions. For example, military police troops practiced moving shoulder-fired Stinger missiles on Taipei’s underground metro system. Other aspects of improved realism in Han Kuang 2025 were the calling up of more reservists— 22,000 participated, a record high— and the integration of two civil defense drills that occur concurrently with Han Kuang but were previously kept separate.

Abrams Tank Delivery and Other Arms Sale Updates

The biggest piece of arms sales backlog news in July was the arrival of a second batch of 42 M1A2T Abrams tanks. Taiwan has now taken delivery of 80 Abrams tanks. The final batch of 28 tanks is expected to arrive in the first quarter of 2026, which seems likely given the successful on-time deliveries of the first two batches. The Abrams sale, valued at $2 billion, was originally notified to Congress in July 2019.

As a reminder, the TSM dataset does not reduce the overall dollar value of the backlog for partial deliveries, which is why there is no change in the backlog’s overall composition or dollar value from June 2025. The Abrams case, the third largest case by dollar value, has been a relatively smooth arms sale compared to other large cases in the backlog. Final delivery in early 2026 will bring the backlog’s overall value below the $20 billion threshold, assuming there are no new arms sales announced between now and then.

There were two other small developments in July worth mentioning:

First, at the end of the month, Raytheon was awarded a $3.5 billion contract to produce Lots 39 and 40 of AIM-120 Advanced Medium-Range Air-to-Air Missiles (AMRAAM), with a completion date in the third quarter of fiscal year 2031. The AMRAAM is one of the most popular U.S. arms sale items, as shown by the 19 foreign country customers mentioned in the contract award announcement. It is unclear when Taiwan will receive the missiles and how many missiles are being produced. Taiwan is currently waiting for delivery of 123 AMRAAM-ER missiles from a 2024 sale of National Advanced Surface-to-Air Missile Systems and 200 AIM-120C-8 missiles from a 2023 sale of various F-16 munitions.

Second, Taiwan’s Ministry of National Defense (MND) announced plans to purchase five types of commercial, off-the-shelf drones, with almost 50,000 to be purchased in 2026. Commercial drones have played a significant role in helping Ukraine stymie Russia and would be an important fixture of an asymmetric defense strategy for Taiwan. The MND has made welcome investments and efforts to expand its use of drones of various sizes and capabilities across the military, including purchasing approximately 1,000 small drones via U.S. arms sales (720 Switchblades and 291 ALTIUS drones).

While the overall value of the U.S. arms sales backlog to Taiwan did not change in July, the on-time delivery of a second batch of Abrams tanks is a good sign and a harbinger of a very large decrease in the backlog early next year.