Partial Deliveries, Future Schedules and Co-Production News

By Eric Gomez and Joseph O’Connor

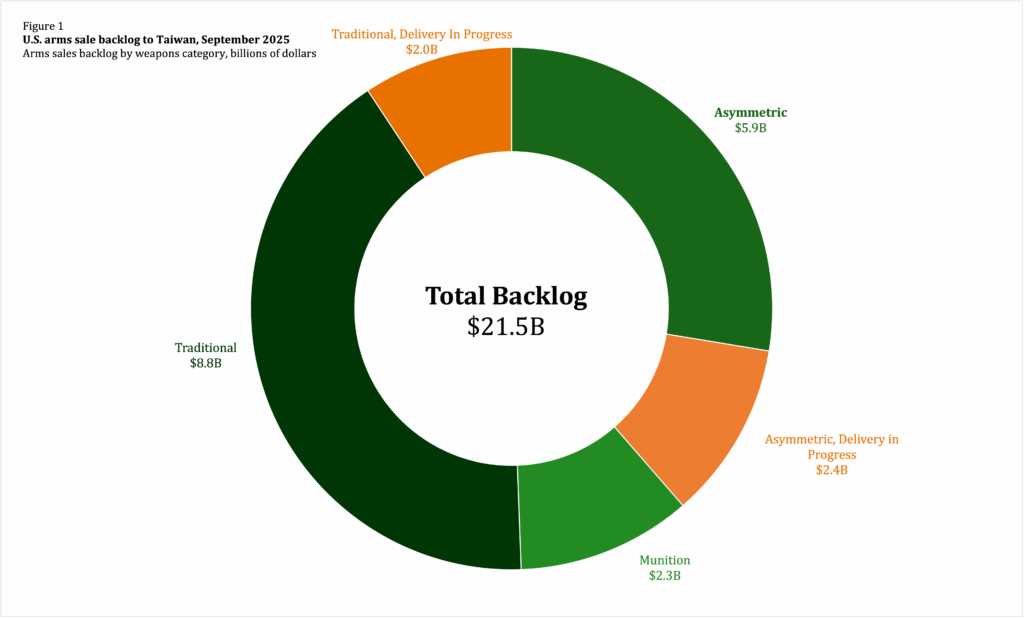

There were many updates to US arms sale cases to Taiwan, but no new Foreign Military Sales (FMS) cases were announced, and no deliveries were completed, so our dataset has not changed from last month. We assess the current backlog to be $21.54 billion.

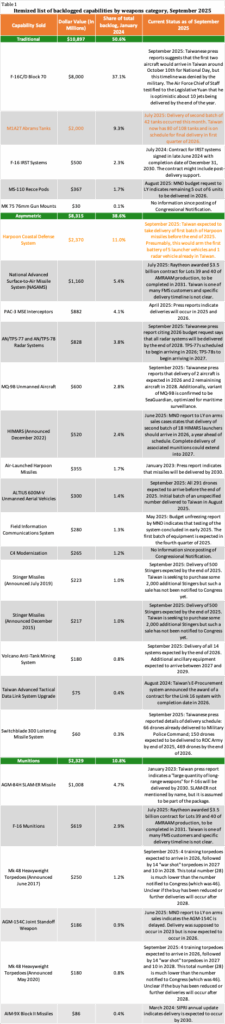

See Figure 1 for a breakdown of this total by category and Table 1 for an itemized list of the FMS cases in the backlog with the latest available information on their status.

Before getting into updates from September 2025, we wanted to explain why our dataset has remained fixed at $21.54 billion despite more information coming out about partial deliveries.

A Note on Methodology

Our dataset retains the full dollar value of an arms sale case as notified to Congress until the arms package is fully delivered. However, as 2025 has progressed, many packages have been partially delivered. This means that the dataset’s top-line backlog dollar value of $21.54 billion is inaccurate.

While we are aware of this accuracy issue, we are not changing the dataset’s methodology at this time and wanted to explain why.

First, FMS cases typically include many more pieces of equipment than the headline item. The sale of 108 Abrams tanks, for example, includes tank recovery vehicles, munitions, machine guns, and spare parts. Reducing the backlog’s dollar value by a fraction of the number of tanks delivered would therefore also produce an inaccurate number.

Second, while it may be easy to track partial deliveries of weapons systems with a bigger media following, like tanks and aircraft, most of the backlog consists of platforms that are smaller in both size and level of attention, making it harder to determine when partial delivery has occurred.

Third, it is not always possible to determine the scale of a partial delivery. For larger capabilities like HIMARS, F-16s, and Abrams tanks, it is easy to keep track of what is in Taiwan and what is not, but for many other cases, precise numbers are not available. The partial delivery of Altius drones from August 2025 is an instructive recent example of this. As of the end of September, no specific number of drones has been mentioned as being delivered, only a “first batch.”

While our current methodology is imperfect, due to data availability constraints, we are concerned that attempting to adjust the backlog’s dollar value based on partial deliveries would also produce an inaccurate number. Therefore, we will stick with our existing methodology despite its flaws.

Additionally, we have made two changes to the Excel file that accompanies these blog posts. First, we deleted the sheet that tracked US arms transfers to Ukraine and their overlap with arms sales to Taiwan because of changes in the overall level of US military aid to Ukraine and a general lack of new information from the State Department. Second, the sheet tracking all FMS cases since the beginning of the Ukraine war had become very long, so we disaggregated it. The new sheets are now labeled “Global FMS Cases 2022,” “Global FMS Cases 2023,” etc.

New Information on Partial Delivery of Switchblade Drones

A press report from Taiwan’s Liberty Times, citing the Ministry of National Defense (MND) 2026 budget request, indicates that, in addition to the partial delivery of Altius-600M drones last month, Taiwan has also started receiving Switchblade 300 drones. The Military Police Command has already received 66 Switchblade drones. The army is receiving 619 Switchblades, with 150 expected by the end of 2025 and 469 by the end of 2026. The original Congressional notification for the Switchblade sale had 720 drones, but from the press report and other sources, this number has evidently been reduced to 685.

The same press report also indicated that a second batch of Altius-600M drones should arrive in Taiwan by the end of 2025, which would complete the FMS case. If the defense industry can stick to these delivery schedules, it will be a significant achievement in the speedy delivery of FMS cases. Both cases were notified to Congress in mid-June 2024, meaning that it took just slightly over a year to go from notification to initial delivery. In the world of arms sales, this is a breakneck pace. Given Taiwan’s urgent need for large numbers of unmanned systems to offset China’s military advantages, the rapid pace of Switchblade and Altius deliveries is a heartening development.

Updated Delivery Timelines for Multiple Arms Sales

We were able to find new information about delivery timelines for five arms sale cases in the backlog. These are covered in alphabetical order.

AN/TPS-77/78 Radar Systems

In October 2024, Congress was notified of an FMS case for an unspecified number of AN/TPS-77 and AN/TPS-78 mobile air defense radar systems valued at $828 million. A press report in September 2025 provided more information about the number of radar systems being procured and their delivery timeline. Taiwan is purchasing four TPS-77s and five TPS-78s. The TPS-77s will begin arriving in 2026, while the TPS-78s will begin arriving in 2027. Both radar systems should be completely delivered by the end of 2028.

F-16 Block 70s

Taiwan’s first F-16 Block 70 aircraft rolled off the production line in March 2025, but the jets have not been flown to Taiwan yet. Taiwanese news sources reported that the first two aircraft would arrive in early October, around the time of the National Day holiday on October 10. The ROCAF has denied the press reports, but the Air Force Chief of Staff testified to the Legislative Yuan (LY) that he expects 10 aircraft to arrive before the end of the year.

Harpoon Coastal Defense System

The $2.37 billion sale of 100 ground-based Harpoon launchers, 25 radar vehicles, and 400 missiles is the largest asymmetric arms sale by dollar value in the backlog. In May 2025, the MND informed the LY that 5 launch vehicles and 1 radar vehicle had already been delivered. A press report from September 2025 indicates that Taiwan will take delivery of the first batch of ground-launched Harpoon missiles before the end of 2025. Assuming that there will be enough missiles to fully arm the five launchers, with four tubes apiece, this would be 20 total missiles.

MK-48 Heavyweight Torpedoes

Taiwan News, citing the MND’s budget request for 2026, reported in September that Taiwan will receive four training Mk-48 heavyweight torpedoes next year, with 14 additional torpedoes arriving in 2027 and 10 in 2028. There was a 2017 Congressional notification for 46 Mk-48s for $250 million, and it is not clear if these 28 total torpedoes represent a reduction in the original arms sale or if deliveries will continue past 2028. These torpedoes will arm Taiwan’s new class of indigenously produced submarines, which have run into delays.

MQ-9B Drones

Last month, we shared information from the 2026 MND budget request saying that two MQ-9B drones are expected to be delivered next year. Additional reporting from September clarifies that the two remaining drones will be delivered in 2028, and that all four will be the SeaGuardian variant of the MQ-9B, optimized for maritime reconnaissance.

Barracuda Missile Co-Production

The final major update from September 2025 was an announcement by Taiwan’s National Chung-Shan Institute of Science and Technology (NCSIST) that it will co-produce with Anduril Industries the Barracuda, a low-cost anti-ship missile. NCSIST claims that each missile will cost approximately $216,000 and be made in Taiwan. Little else is known about the Barracuda or the details of the co-production agreement, but if NCSIST and Anduril can indeed join forces to manufacture such missiles in Taiwan at scale, it would be a major positive development for Taiwan moving toward a sustainable asymmetric defense posture.

Co-production means that Taiwanese companies would produce American-designed weapons in Taiwan. Such agreements would require export licensing of sensitive US technology, which undergoes a complex and lengthy review and approval process. This may mean a slower up-front process, but successful co-production agreements between the United States and Taiwan would take pressure off an overburdened US defense industrial base while also giving the Taiwanese defense industry experience building more weapons. The Barracuda missile is not part of the backlog because it does not have an FMS case notified to Congress.

Conclusion

Although the dollar value of Taiwan’s arms sale backlog has not changed, 2025 has been a busy year for US-Taiwan arms sales. There is considerably more information available about delivery schedules and partial deliveries than last year, including much-faster-than-expected timelines for critical asymmetric capabilities like man-portable drones. We hope our methodological note explains our reasoning for not adjusting the backlog’s dollar value yet despite the partial delivery developments.