Trump Administration Notifies Congress of $11 Billion in New Taiwan Arms Sales

By Eric Gomez and Joseph O’Connor

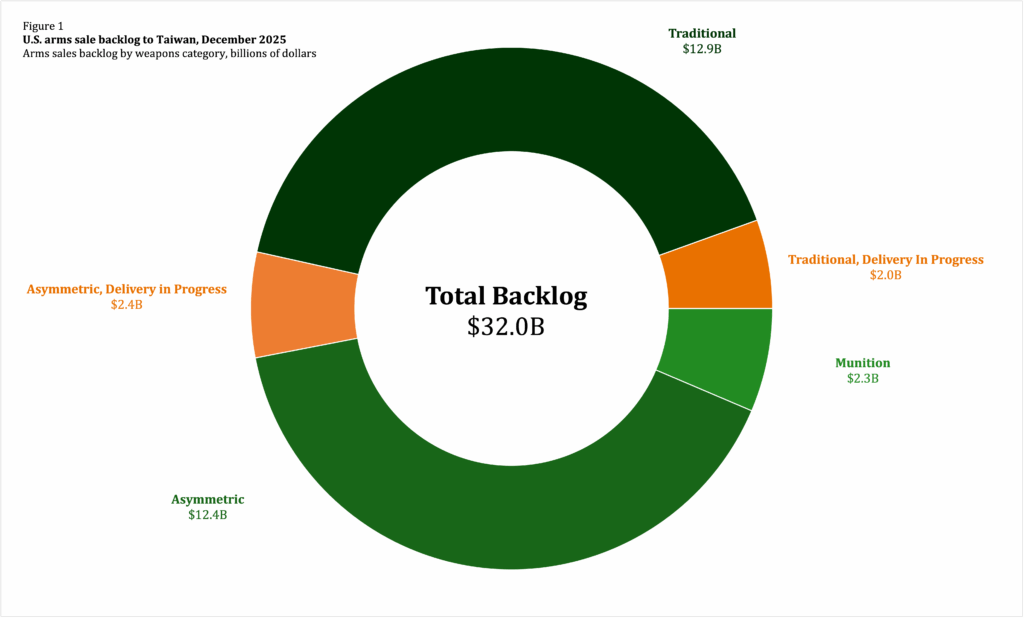

On December 17, 2025, the Trump administration notified Congress of over $11 billion worth of new Foreign Military Sales (FMS) cases to Taiwan, the largest ever package of US arms sales to Taiwan by dollar value. This new package raises the total dollar value of the US arms sale backlog to Taiwan to approximately $32 billion. At least $4.4 billion of this amount has been partially delivered to Taiwan.

Seeing such a steep growth in the total dollar value of the backlog seems alarming at first glance, but overall, the December 2025 FMS cases are a good thing for Taiwan. The new arms sales are heavily weighted in favor of asymmetric systems that will likely be produced and delivered rapidly.

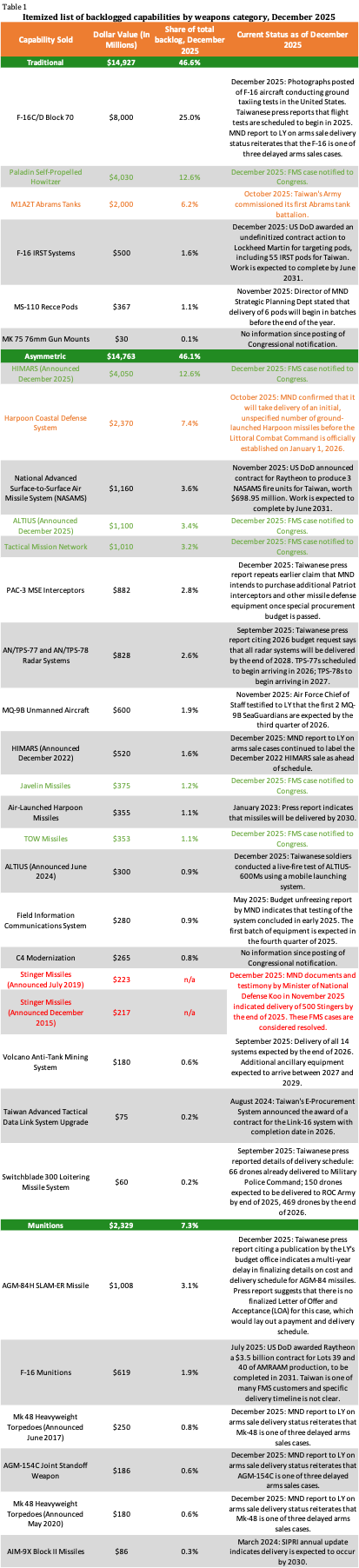

As always, Figure 1 shows how the backlog is divided between traditional systems, asymmetric systems, and munitions. Table 1 is an itemized list of the FMS cases that Taiwan is waiting to receive, with the latest information on delivery schedules. In Table 1, items in green text are new additions to the backlog; those in red text are newly delivered items that have been removed from the backlog, and yellow/orange text represents arms sales worth at least $1 billion that are partially delivered.

Breaking Down the December Package

The Arms Export Control Act requires that Congress receive notification of new FMS cases above a certain dollar threshold before those cases can advance. After notification, Congress has a specified period, depending on the recipient country (30 days in Taiwan’s case), during which it can block the sale by passing a joint resolution of disapproval. If Congress does not pass such a resolution, then the FMS sale goes ahead. Congressional notifications are how Taiwan Security Monitor establishes its universe of arms sales for the backlog.

The $11 billion package contains eight unique FMS cases. The new cases are heavily weighted in favor of asymmetric capabilities, which represent five cases worth approximately $6.9 billion. The other three sales are for one traditional capability (Paladin self-propelled howitzers) and two maintenance sales (spare and repair parts for Harpoon missiles and attack helicopters).

The distinction between asymmetric capabilities, traditional capabilities, and munitions is explained in a November 2023 article by Eric Gomez, published with the Cato Institute, during the nascency of the backlog dataset. Additionally, the two maintenance sales have not been added to the backlog because they support capabilities that Taiwan already possesses, and tracking the delivery of spare parts is not possible with the available data.

Asymmetric Capabilities: 5 Cases, $6.9 Billion

The most heartening aspect of the December 2025 FMS package to Taiwan is its heavy emphasis on asymmetric weapons systems. Taiwan has historically under-invested in asymmetric capabilities, which are less flexible, but tend to be less expensive, more mobile, and harder for China’s military to counter in a high-intensity conflict.

When Gomez published the first version of the Taiwan arms backlog dataset in late 2023, asymmetric capabilities were $4.2 billion out of $19.17 billion, or 22 percent. With the December 2025 arms sales, these numbers are now $14.7 billion out of $32 billion, or 46 percent. This growing emphasis on asymmetric capabilities is a step in the right direction for Taiwan.

The five December 2025 asymmetric capabilities arms sales are:

- HIMARS launchers and munitions, $4.05 billion

- ALTIUS loitering munitions/drones, $1.1 billion

- Tactical Mission Network, $1.01 billion

- Javelin Missiles, $375 million

- TOW Missiles, $353 million

There are several things to note with this mix of capabilities:

Firstly, the two largest arms sales in this category—HIMARS rocket artillery launchers and ALTIUS drones—are on efficient production lines, which means they will likely be delivered to Taiwan relatively quickly. According to Taiwan’s Ministry of National Defense, a December 2022 sale of HIMARS launchers and munitions that should arrive in 2026 is the only FMS case out of 14 that is considered ahead of schedule. ALTIUS drones likewise have arrived in Taiwan rapidly, with an initial tranche arriving in Taiwan (August 2025) only a little over one year after Congress was notified of the sale (June 2024).

Secondly, our dataset codes Javelin and TOW missiles as asymmetric weapons and not munitions because both FMS cases include other systems besides the missiles themselves that make it more appropriate to see them as an asymmetric capability rather than just munition reloads. The Javelin sale includes additional launcher units, while the TOW sale includes kits to mount launchers to Humvee vehicles.

Finally, once Taiwan receives the 82 HIMARS launchers from the December sale on top of the 29 from previous arms sales, it will have the second-largest inventory of HIMARS in the world after the United States. HIMARS has demonstrated its value as an asymmetric, long-range precise rocket artillery system in the ongoing war in Ukraine, and it is in high demand in Taiwan, alongside many frontline NATO countries. The range and mobility of HIMARS make it an excellent choice for an asymmetric defense strategy.

Traditional Capabilities: 1 Case, $4.03 Billion

The only traditional capability in the December 2025 arms sale package is the sale of 60 M109A7 Paladin self-propelled howitzers plus support equipment such as ammunition carriers and armored recovery vehicles. Taiwan previously attempted to purchase 40 M109A6 Paladins in 2021, but shortly after the Ukraine war began, the sale was cancelled, and Taiwan instead focused on buying additional HIMARS.

Taiwan could have probably found better ways to spend $4 billion, but in the world of traditional capabilities, self-propelled howitzers are not that bad an investment. Artillery pieces are still important in modern battlefields, and while it may not be as mobile as a HIMARS launcher, a Paladin can still use mobility to improve its survivability. Taiwan also already operates earlier variants of the Paladin, which should help with the quick absorption of the new systems. Finally, the defense industrial base has improved its production rates of 155mm artillery shells and Paladin howitzers because of the Ukraine war, which will hopefully mean a shorter gap between Congressional notification and delivery to Taiwan.

Stinger Delivery Completed

While the massive recent arms sale package has understandably received most of the attention this month, there were two arms sales that were removed from the backlog. Taiwan was waiting on the delivery of 500 Stinger man-portable air defense missiles that were sold across two FMS cases (December 2015 and July 2019) worth a combined $440 million.

Though Taiwan originally planned on purchasing just 250 for the Navy, and got relatively close to finalizing a contract a few years after the 2015 notification to Congress, the Taiwanese Army desired Stingers of its own, halting progress on the sale to allow for renegotiations. A 2024 MND document further mentions that supply chain issues and material shortages exacerbated by the COVID-19 pandemic contributed to sluggish progress on Stinger production, and that since 2021, there have been two official letters of protest submitted about the project.

A budget unfreezing report from earlier in 2025 and testimony by Defense Minister Wellington Koo to the Legislative Yuan in November indicated that Taiwan would finally receive a delivery of 500 Stingers, which would satisfy the two FMS cases, by the end of 2025. Taiwan has reportedly developed plans to purchase approximately 2,000 additional Stingers from the United States, but such a sale has not yet received Congressional notification.

Other Case Updates: F-16 Testing and IRST Production

News emerged about the status of F-16V production this month, as the first Taiwanese airframe, #6831, underwent taxiing tests on December 20 and a flight test on December 30, both at Lockheed Martin’s production facility in Greenville, South Carolina. Delivery of the aircraft and additional testing of more airframes are expected to begin early this year. Once the first airframe arrives in Taiwan, we will mark the F-16 case as being a delivery in progress.

On December 31, the U.S. Air Force awarded a $328.5 million undefinitized contract action (UCA) to Lockheed Martin for production of three types of targeting pods, including Sniper, IRST, and LANTIRN pods. Of this, 55 IRST pods are to be produced for the ROCAF, using $157.3 million worth of FMS funds for Taiwan, and work is expected to be completed by June 2031. It is worth noting that a UCA is expressly not final in terms of cost and quantity, but authorizes production of those systems. The last update for the IRST case was in June 2024, when a contract was signed for production.

Conclusion

The December 2025 arms sale package significantly increases the size of the backlog while also improving its underlying composition. Unlike previous FMS cases that added slow-to-deliver, traditional capabilities like F-16s and Abrams tanks, the new cases prioritize asymmetric systems, which will likely have faster production times and have a lower per-unit cost. A Taiwanese military that is better prepared to implement an asymmetric defense strategy should be able to impose costs on China through dispersed fires, expendable unmanned systems, and mobile air defense.

This update also highlights the main challenge for 2026: closing the gap between FMS notification to Congress and weapons in the hands of Taiwan’s soldiers. The recently completed Stinger cases show how even sales of asymmetric capabilities can be slowed down by bureaucratic inefficiencies, supply chain disruption, and defense industry bottlenecks. Maintaining progress on HIMARS, ALTIUS, and other asymmetric programs will require ongoing prioritization by both governments, transparent delivery timelines, and consistent follow-through on training, basing, and sustainment.