Early Trump Admin Arms Sales and Rumors of a Big Request from Taiwan

By Eric Gomez

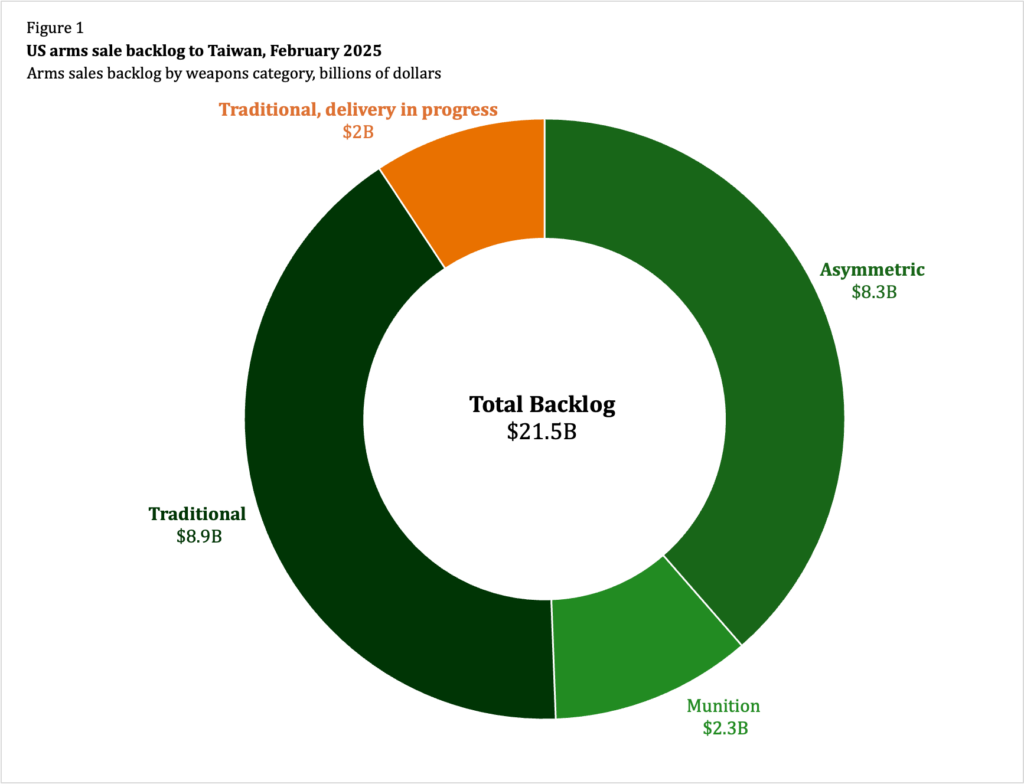

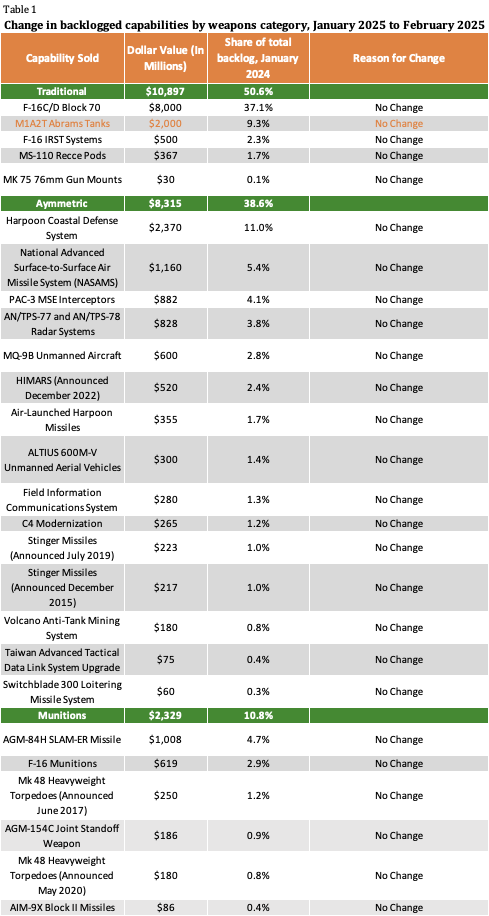

There were no new US arms sales to Taiwan announced or delivered between January and February 2025. The backlog remains $21.54 billion.

Figure 1 shows how the backlog is divided among traditional capabilities, asymmetric capabilities, and munitions. Table 1 contains an itemized list of arms sales in the backlog.

Sources: Defense Security Cooperation Agency: Press Release, US Congressional Record; “Major Arms Sales,”; DCSA Release; DCSA Major Arms Sales; DCSA Press Media TECRO; SIPRI Arms Transfers Database, Stockholm International Peace Research Institute; US Congressional Record; “Major Arms Sales,” Defense Security Cooperation Agency; “Defense News,” Ministry of National Defense, Republic of China; “Letter from the Ministry of National Defense, Submitting a Written Report on the ‘Implementation Status of US Arms Sales to Taiwan’ for the 2024 Budget Resolution,” Ministry of National Defense, June 12, 2024; and “Excerpt from ‘Ministry of National Defense 2024 Annual Budget Assessment Report’,” Ministry of National Defense, October 2023; and “Information on US Arms Sales to Taiwan,” Ministry of National Defense, October 30, 2024.

Early Trump Arms Sales

February 2025 was a busy month in the world of foreign military sales (FMS) despite none going to Taiwan. The Trump administration notified Congress of nine FMS cases in February. Five of these cases, with a combined value of $10.4 billion, were for Israel.

In three of the Israel arms sales, the Trump administration bypassed the standard Congressional review period for FMS cases by stating an emergency existed justifying an immediate sale. Normally, Congress would have either 15 or 30 days—depending on the recipient country, Israel’s period is 15 days—to issue a joint resolution of disapproval to block the arms sale. The Trump administration’s invocation of an emergency is legal under the Arms Export Control Act, which governs FMS cases, but drew condemnation from several members of Congress arguing that the administration cut Congress out of politically sensitive sales.

Between inauguration day and the end of February, Middle Eastern countries have been the recipient of eight out of ten FMS cases (Japan and Romania have one sale apiece over the same period). It will be interesting to see if this trend continues. While there appears to be a consensus around reducing US focus on Europe, the administration’s approach to the rest of the world is not settled. Much of the administration’s senior foreign policy team has talked about focusing more on China, but recent arms sales and developments in March 2025 suggest more attention on the Middle East at least in the near term.

Rumors of a Large Taiwan Arms Sale

While there has been no official notification of the next US arms sale to Taiwan, the rumor mill was active in February. A Reuters report citing “sources familiar with the situation” said that Taiwanese and American officials were discussing a large arms sale with a price tag between $7 and $10 billion. The full scope of capabilities under discussion was not mentioned, but the Reuters article references HIMARS munitions and coastal defense cruise missiles. Taiwan is already waiting for delivery of these weapons from earlier arms sales, but both are asymmetric capabilities that would be good acquisitions for Taipei.

The last time the press reported on rumors of a Trump administration arms sale to Taiwan was in November 2024, shortly after the election. The Financial Times reported that Taiwan was thinking about making an overture to the incoming administration with a large weapons purchase. Traditional capabilities like F-35 fighter aircraft, E-2D airborne early warning and control aircraft, and retired Ticonderoga-class cruisers featured heavily in the November 2024 rumors, and the dollar figure was much higher at $15 billion.

With the caveat that none of the above information has been confirmed by either the US or Taiwanese governments, the change between the two reports is interesting. Traditional capabilities factored much more heavily in the earlier report, while the more recent report focused on asymmetric capabilities. Both packages would result in a sizable increase in the Taiwan arms sale backlog, but based on recent delivery timelines the February 2025 capabilities should arrive faster than the November 2024 capabilities.

Hopefully, as these negotiations unfold, Taiwan and the United States will keep moving closer to sales of asymmetric capabilities that are easier for Taiwan to afford and more likely to be delivered quickly. The appeal of traditional capabilities like F-35s or large surface warships is understandable, but given Taiwan’s levels of defense spending and longer delivery timelines buying more traditional capabilities would be an imprudent use of time and money.

Conclusion

February 2025 did not see any changes in the US arms sale backlog to Taiwan, but it did provide a peek into important issues that could impact the backlog. The Trump administration’s early emphasis on the Middle East for new arms sales raises questions about whether the administration’s actions will reflect its “China first” rhetoric. New rumors about a pending US arms sale to Taiwan suggest ongoing tension between Taiwan going all in on asymmetric defense versus securing Trump’s favor via the purchase of high-priced traditional capabilities.

For the full dataset, click below: